All Categories

Featured

Table of Contents

Trustees can be household members, relied on people, or monetary institutions, depending on your preferences and the complexity of the depend on. The objective is to guarantee that the trust fund is well-funded to fulfill the kid's long-term financial demands.

The function of a in a kid assistance trust can not be understated. The trustee is the private or company in charge of handling the trust's assets and ensuring that funds are distributed according to the terms of the count on arrangement. This consists of making sure that funds are made use of solely for the kid's advantage whether that's for education and learning, healthcare, or daily expenses.

They need to additionally provide normal records to the court, the custodial parent, or both, depending upon the regards to the depend on. This accountability makes certain that the trust fund is being handled in a manner that advantages the kid, protecting against abuse of the funds. The trustee also has a fiduciary responsibility, indicating they are lawfully obligated to act in the ideal interest of the youngster.

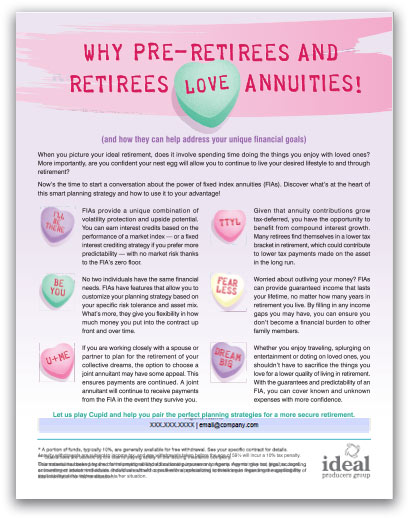

By buying an annuity, moms and dads can ensure that a fixed quantity is paid out regularly, regardless of any fluctuations in their income. This gives comfort, understanding that the kid's requirements will remain to be fulfilled, no matter the financial conditions. One of the vital advantages of making use of annuities for child support is that they can bypass the probate process.

Who should consider buying an Tax-efficient Annuities?

Annuities can likewise supply protection from market changes, making sure that the kid's financial support remains secure even in volatile financial problems. Annuities for Youngster Support: An Organized Remedy When setting up, it's crucial to take into consideration the tax effects for both the paying parent and the child. Trusts, depending on their structure, can have different tax obligation therapies.

In various other instances, the recipient the kid may be liable for paying taxes on any type of circulations they obtain. can additionally have tax implications. While annuities offer a secure income stream, it is essential to recognize just how that earnings will certainly be taxed. Depending on the structure of the annuity, payments to the custodial moms and dad or youngster may be considered taxed earnings.

One of one of the most substantial benefits of making use of is the capacity to shield a youngster's monetary future. Counts on, specifically, offer a degree of protection from lenders and can make certain that funds are used sensibly. A trust can be structured to guarantee that funds are only utilized for particular purposes, such as education or medical care, protecting against abuse.

Who should consider buying an Variable Annuities?

No, a Texas youngster assistance count on is particularly designed to cover the kid's important demands, such as education, medical care, and everyday living expenditures. The trustee is legitimately obliged to make sure that the funds are made use of only for the benefit of the kid as laid out in the trust arrangement. An annuity provides structured, predictable payments with time, making sure constant financial backing for the kid.

Yes, both youngster support counts on and annuities included possible tax obligation ramifications. Trust fund revenue may be taxed, and annuity settlements can likewise undergo taxes, depending on their structure. It's important to speak with a tax obligation specialist or economic expert to comprehend the tax obligations connected with these economic devices.

How does an Deferred Annuities help with retirement planning?

Download this PDF - Sight all Publications The senior population is huge, expanding, and by some price quotes, hold two-thirds of the private riches in the United States. By the year 2050, the variety of elders is predicted to be nearly two times as big as it remained in 2012. Considering that many senior citizens have actually had the ability to save up a savings for their retirement years, they are usually targeted with fraudulence in a manner that younger people without financial savings are not.

The Lawyer General gives the following pointers to think about prior to buying an annuity: Annuities are complex investments. Annuities can be structured as variable annuities, taken care of annuities, prompt annuities, deferred annuities, and so on.

Customers ought to read and understand the syllabus, and the volatility of each financial investment detailed in the prospectus. Financiers ought to ask their broker to clarify all terms and problems in the prospectus, and ask inquiries concerning anything they do not understand. Fixed annuity products might additionally carry risks, such as lasting deferral periods, disallowing financiers from accessing all of their money.

The Attorney general of the United States has actually filed claims against insurance coverage firms that marketed unsuitable delayed annuities with over 15 year deferment durations to investors not anticipated to live that long, or who need accessibility to their money for health and wellness treatment or helped living expenditures (Guaranteed income annuities). Investors ought to make sure they recognize the long-lasting repercussions of any annuity purchase

How does an Secure Annuities help with retirement planning?

The most significant cost connected with annuities is usually the abandonment fee. This is the percent that a consumer is charged if he or she takes out funds early.

Consumers may want to speak with a tax specialist prior to spending in an annuity. The "safety and security" of the financial investment depends on the annuity. Beware of representatives that strongly market annuities as being as safe as or much better than CDs. The SEC advises customers that some sellers of annuities products prompt consumers to switch to an additional annuity, a method called "churning." Regrettably, agents may not sufficiently divulge fees connected with changing financial investments, such as brand-new abandonment charges (which generally begin again from the day the product is switched), or dramatically altered benefits.

Representatives and insurance policy companies might offer perks to attract capitalists, such as additional passion factors on their return. Some deceitful representatives encourage consumers to make impractical financial investments they can not afford, or purchase a long-lasting deferred annuity, also though they will certainly require access to their cash for health and wellness care or living expenditures.

This section supplies information useful to retirees and their households. There are numerous celebrations that might influence your advantages.

What is the process for withdrawing from an Guaranteed Income Annuities?

Trick Takeaways The beneficiary of an annuity is a person or company the annuity's proprietor assigns to receive the agreement's fatality benefit. Different annuities pay to recipients in different methods. Some annuities might pay the beneficiary stable settlements after the agreement holder's fatality, while other annuities might pay a survivor benefit as a round figure.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Interest Annuity Vs Variable Investment Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans W

Exploring What Is Variable Annuity Vs Fixed Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Tax Benefits Of Fixed Vs Variable Annuities Why Cho

More

Latest Posts