All Categories

Featured

Table of Contents

Keep in mind, nonetheless, that this does not say anything regarding changing for inflation. On the plus side, even if you think your alternative would certainly be to buy the securities market for those 7 years, and that you 'd get a 10 percent yearly return (which is far from particular, specifically in the coming decade), this $8208 a year would certainly be greater than 4 percent of the resulting nominal supply worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with four settlement alternatives. The regular monthly payout here is highest for the "joint-life-only" option, at $1258 (164 percent higher than with the instant annuity).

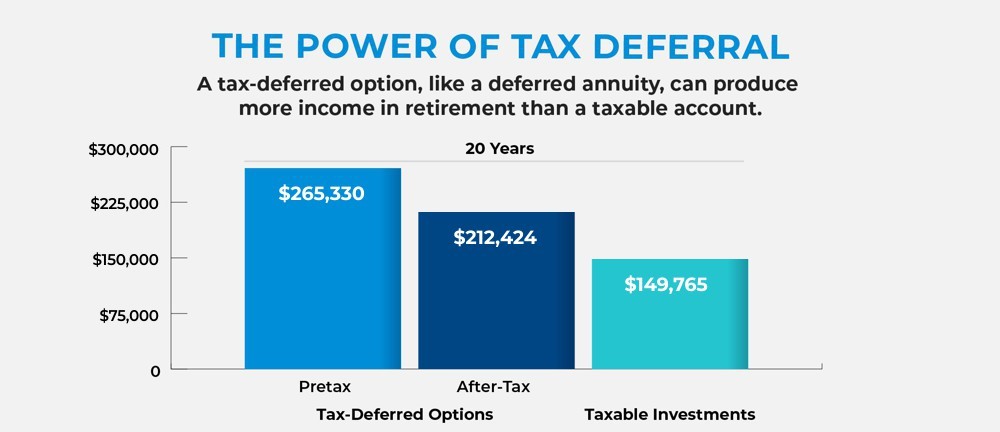

The means you buy the annuity will certainly determine the answer to that concern. If you buy an annuity with pre-tax bucks, your costs reduces your taxed earnings for that year. Nonetheless, eventual payments (month-to-month and/or round figure) are strained as normal income in the year they're paid. The advantage right here is that the annuity might allow you delay tax obligations past the internal revenue service payment restrictions on Individual retirement accounts and 401(k) plans.

According to , buying an annuity inside a Roth plan causes tax-free repayments. Getting an annuity with after-tax dollars outside of a Roth leads to paying no tax obligation on the section of each settlement associated to the original costs(s), yet the remaining portion is taxed. If you're setting up an annuity that starts paying prior to you're 59 years of ages, you may need to pay 10 percent very early withdrawal penalties to the IRS.

Deferred Annuities

The advisor's primary step was to establish a thorough economic prepare for you, and afterwards explain (a) how the proposed annuity fits into your total plan, (b) what alternatives s/he taken into consideration, and (c) how such choices would certainly or would certainly not have resulted in reduced or greater compensation for the expert, and (d) why the annuity is the superior option for you. - Retirement annuities

Obviously, a consultant might attempt pushing annuities even if they're not the very best fit for your circumstance and objectives. The factor might be as benign as it is the only item they offer, so they drop victim to the proverbial, "If all you have in your tool kit is a hammer, quite soon everything starts resembling a nail." While the consultant in this situation may not be underhanded, it raises the danger that an annuity is an inadequate option for you.

How long does an Annuity Withdrawal Options payout last?

Considering that annuities commonly pay the representative offering them much higher commissions than what s/he would certainly receive for spending your money in common funds - Fixed vs variable annuities, allow alone the zero payments s/he 'd receive if you purchase no-load mutual funds, there is a huge motivation for representatives to press annuities, and the more complex the far better ()

An underhanded advisor recommends rolling that quantity into new "far better" funds that simply happen to bring a 4 percent sales tons. Accept this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to perform far better (unless you picked a lot more inadequately to start with). In the very same instance, the consultant could steer you to buy a complicated annuity keeping that $500,000, one that pays him or her an 8 percent payment.

The expert hasn't figured out how annuity settlements will be strained. The consultant hasn't divulged his/her payment and/or the fees you'll be billed and/or hasn't revealed you the influence of those on your eventual payments, and/or the compensation and/or fees are unacceptably high.

Present rate of interest prices, and therefore projected payments, are historically reduced. Even if an annuity is appropriate for you, do your due diligence in comparing annuities offered by brokers vs. no-load ones sold by the releasing business.

How do I get started with an Retirement Annuities?

The stream of month-to-month repayments from Social Security is comparable to those of a delayed annuity. In fact, a 2017 comparative evaluation made an in-depth contrast. The following are a few of one of the most prominent factors. Given that annuities are voluntary, individuals purchasing them usually self-select as having a longer-than-average life span.

Social Safety benefits are completely indexed to the CPI, while annuities either have no inflation protection or at many use a set percent annual rise that may or may not make up for rising cost of living in full. This type of rider, similar to anything else that raises the insurance firm's danger, needs you to pay more for the annuity, or approve reduced payments.

Why is an Annuity Payout Options important for long-term income?

Please note: This short article is planned for educational functions only, and must not be thought about financial recommendations. You ought to seek advice from an economic expert before making any major economic decisions. My profession has actually had many uncertain weave. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in fragment detector R&D, research study placement in experimental cosmic-ray physics (including a couple of sees to Antarctica), a brief job at a little design solutions business sustaining NASA, followed by starting my own tiny consulting technique supporting NASA tasks and programs.

Given that annuities are intended for retired life, taxes and penalties might use. Principal Protection of Fixed Annuities. Never shed principal because of market performance as taken care of annuities are not bought the marketplace. Even throughout market declines, your money will not be impacted and you will not lose cash. Diverse Financial Investment Options.

Immediate annuities. Made use of by those that want trusted earnings immediately (or within one year of purchase). With it, you can customize earnings to fit your requirements and create income that lasts permanently. Deferred annuities: For those who wish to grow their money in time, however agree to defer access to the cash up until retired life years.

What is the most popular Retirement Annuities plan in 2024?

Variable annuities: Offers better possibility for growth by spending your money in investment alternatives you select and the capacity to rebalance your portfolio based upon your choices and in a manner that straightens with changing monetary goals. With fixed annuities, the company invests the funds and provides a rates of interest to the customer.

When a death case happens with an annuity, it is essential to have a named beneficiary in the contract. Different choices exist for annuity survivor benefit, depending upon the agreement and insurance firm. Choosing a reimbursement or "duration specific" option in your annuity offers a fatality advantage if you die early.

Why is an Immediate Annuities important for my financial security?

Calling a beneficiary various other than the estate can help this process go extra efficiently, and can aid guarantee that the profits go to whoever the individual wanted the money to go to rather than going via probate. When existing, a death benefit is immediately consisted of with your contract.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Interest Annuity Vs Variable Investment Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans W

Exploring What Is Variable Annuity Vs Fixed Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Tax Benefits Of Fixed Vs Variable Annuities Why Cho

More

Latest Posts